Building a budget can be SCARY.

Especially when you’ve never done it before, or the only times you’ve ever heard the word “budget” was when it was connected to not getting that new toy or pair of shoes you wanted growing up.

If you’ve never built a budget before, and the thought of it brings up feelings of shame and worry, I want you to know – you aren’t alone. One of my biggest beefs with the whole “money management and budgeting” industry is that it’s a machine designed to keep you just rich enough… a system that tells you avocado toast and Starbucks and being an idiot is what is keeping you from owning a home in the United States of America.

It’s a system that wants you to believe that all you have to do is spend less, have no debt, pay cash for everything. Well, I don’t know about you, but I am NOT waiting until I am 72 years old to enjoy my life because that is when I will finally be “out of debt”. It’s a system that finds glory and honor in being “budget poor”.

I CERTAINLY call bullshit on the whole “you need to spend less” camp; I am very much about let’s teach people how to earn more while they learn to be mindful about their financial priorities.

Let’s teach people the freedom of choice that budgeting brings, so they can spend their money with intent and joy.

After all, money is MEANT to be spent. Saving for saving’s sake is just scarcity and silliness. We put saving into our budget so that we can spend money later.

I believe in the merging of living a good life with making budget building decisions that reflect our fiscal situation.

I believe in making money decisions that are born from a combo of living your best life (I’m going to Disneyland and staying in the Grand Californian!), mental health care (I guess this is still the Disneyland thing), and cash flow realities (I’m willing to pay this trip off, at 14% interest, over the next 12 months, by making payments of $XXXX because I can afford this with my cash flow). THIS is the budget building game I want you to learn.

I believe that consumer debt is a systemic issue and that while personal responsibility and knowledge are required to play the budget game, one cannot make responsible choices if the game is rigged, or the rules keep changing.

“Spending more than one earns” should not be a morality statement. It should be an indication that we’ve failed to teach people how the money and budget game works.

This “spend what you want to have a great life” belief that I hold isn’t prosperity gospel thinking. This isn’t an “abundance mindset”.

This is about self-awareness and the kind of math we can all do.

This is about refusing to live in learned helplessness that we have no control over our money. We all have the ability to budget.

My friend Jacquette Timmon’s says, “You don’t manage money, you manage choices,” and I am so down with that I can’t even. Pass me another slice of avocado toast.

“You don’t manage money, you manage choices”

Jacquette M Timmons

Three First Steps Toward Building Your Very First Budget Responsibly

A budget is an estimate of income and expenditure for a set period of time. That’s it. It’s neutral.

Keep that in mind as you follow the following steps to begin budgeting.

Step One: Learn to constantly ask these three questions.

- How much money is coming in? (called income or revenue)

- How much money is going out? (called expenses)

- When are these ins and outs happening?

Look through your bank and credit card statements for the past few months. If you want to get reallllly fancy, look at the last 12 months.

Make a mental note of what you learn. Observe if there is a pattern to the flow, or if its all willy-nilly.

- Determine how and when income hits your bank accounts.

- Determine which expenses are fixed/regular. You’ll have recurring monthly expenses, like a monthly subscription to SECO, and recurring annual expenses, like an annual subscription to Acuity.

- Determine which expenses are irregular, or what can be called “incidentals”.

This step is simply for you to make friends with looking at real numbers. Budgeting without panicking – remember, budgeting is neutral. You are merely becoming aware. There are no judgments or decisions being made yet. This isn’t the actual budget.

Step Two: Record and Observe the past data.

Eventually, you will gather this data into some sort of table – you can use a paper and pen, spreadsheet, or whiteboard. This is called bookkeeping, or keeping track of money that already happened. It’s important to know what happened in the past, in order to make a guess about the future.

You’ll want to organize the data so that it is really clear to see the ebb and flow as you get more familiar with your money.

FOR NOW, HOWEVER: Make lists. That’s it! Just lists.

Here are the budget lists to make:

- All the income, with the dates, then totaled up.

- All the recurring, monthly expenses, with the dates, then totaled up.

- All the incidentals, with dates, then totaled up.

- FOR THE FANCY PANTS PEOPLE: All the annual expenses, with dates, totaled up.

Once you have the lists made, you’ll be able to subtract the expenses from the income and know if you are making enough to cover your expenses, if you need to make more money, or if you need to spend differently.

As you observe the recorded data, you’ll see patterns. There will be patterns of when and what you spend – your unintentional budget, if you will, for example:

- Every Tuesday, you are teaching a long day, so you grab Starbucks on the way home from dropping off the kiddos at school, and spend about $11.

- On the 15th of each month, your Apple Music subscription gets auto-billed for around $10.

- Every June, your students start getting ready for college auditions, and you spend about $200 in sheet music for them.

- Every March, your annual Zoom payment gets auto-billed – about $180.

- Around the beginning of the month, monthly autopays of tuition start coming in.

- Every Fall, you get asked to music direct at the local highschool and they pay you a stipend of $500

- Each month, there is about $1500 spent on “random sh*t”, from onlline courses, to travel, to more Starbucks, to pencils and post-its.

These patterns are what you’re going to use to make a budget.

Step Three: Decide ahead of time where the money gets to go. The budget!

Remember, a budget is an estimate. You can make this educated guess based on those past months and the patterns you observed. Which expenses do you expect to happen next month because they are fixed, and which do you expect to happen because there is something that would cause an irregular expense?

Using past data, make some decisions about where your money will be spent in future months. Write it down so you can see it with your own eyeballs.

You can totally use paper and pencil for this – remember you’re just starting out. If you can muster up a budgeting spreadsheet, that would be more efficient in the long run. Make it more about being accessible to YOU than about some fancy tool. (Although fancy tools like YNAB can be fun, if you can handle the learning curve!)

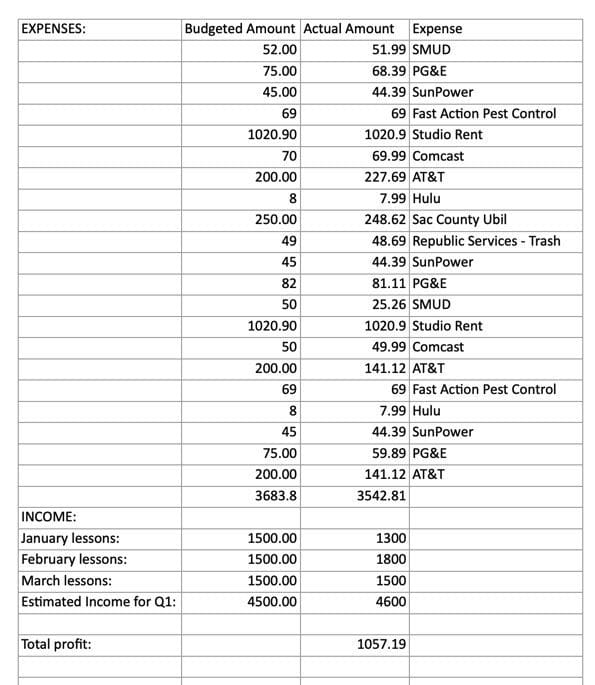

For the sake of a good laugh, here is a photo of one of the very first budgets I made without any help from anyone, so you can see how this is going to be a work in progress.

It’s missing so many items! It’s sloppy! I completely overestimated some things, and underestimated others. I had NO IDEA how much revenue I was going to make every month, and it showed. Budgeting was hard.

And you know what else?

This crappy budget TOTALLY helped me fill in the gaps.

It showed me I needed to separate my bank accounts and not do all the money in one account.

It taught me that I wasn’t paying close enough attention to things like, you know, groceries (it’s not even on here! HAHA)!

It was glaringly obvious that I had no idea WHEN the money was actually going to magically appear or disappear.

This budget nudged me toward creating offers that allowed consistent, predictable income, instead of pay per lesson.

AND – this budget allowed me to get my feet wet, and eventually create beautiful budgets that are not only multi-layered, but forecast up to two years in the future.

Start with what you know. A beginning budgeting baby you must be.

Go Slow and Practice – Digital Envelopes

The envelope budgeting system was a way that people did budgeting with their paychecks. Each week, a paycheck was cashed, whoever was responsible for the budget would take the cash and break it up amongst several physical envelopes. This would ensure they would have enough money for their needs. Each envelope would be labeled with an expense and an amount; Rent $250, Groceries $25, Medical $15, clothing $50, etc. When they were done dividing the cash up, they’d have no cash left in their hands.

There was no other money to account for. They saw exactly what they had. If the medical bill was $20, they’d have to take $5 from the groceries or the rent, and somehow get that $5 back into an envelope they took it from. If they had extra cash, they padded an envelope with extra.

What I like about the cash-based old-school envelope budgeting system is that it’s so tangible. You see right before your very own eyeballs if you have enough or you do not.

Many of the apps out there that help with budgeting are essentially a digital version of the envelope system.

When you first start to budget, you’re going to make mistakes. KEEP DOING IT ANYWAY.

You’re going to have months where you have digital envelopes that add up to $4500, and you only have a $3000 stack of digital cash.

Months where you have a $6000 stack of digital cash, and then instead of padding your digital envelopes with that cash, or creating a new envelope called “savings”, you blow it.

As you get more and more familiar with your choices and your actions, you can manage those decisions – and in doing so, manage your budget.

Do you budget? If so, what tools do you use?

What would you like to get better at around budgeting?

Let me know in the comments below, or shoot the team at the email hey@faithculturekiss.com.

All My Budgeting BeastyBoss,

0 Comments