Buy Now Pay Later for Online Courses: The Ethics, Economics, and Smart Strategy Guide

When payment flexibility becomes a relationship liability—and what to do about it – A strategic guide for teachers, coaches, course creators, and service providers navigating the ethics and economics of payment options

Picture this: You’re scrolling through your Stripe dashboard, and you notice something interesting. Some of your customers are seeing “Pay in 4” options at checkout—Klarna, Afterpay, Sezzle, Affirm—while others aren’t. Your conversion rates look solid, but you’re wondering: Should I be actively encouraging these payment options? Are they helping or hurting my business and my clients?

If you’ve found yourself in this exact situation, you’re not alone. The Buy Now, Pay Later space has exploded, and as coaches, course creators, and service providers, we’re caught between the promise of higher conversions and the reality of what these payment options mean for our clients and our businesses.

Most BNPL guides focus on conversion rates and setup instructions. But as transformation-focused entrepreneurs, we need to consider the full impact on our clients’ lives and our business relationships. This guide helps you make payment decisions that align with your values AND your revenue goals.

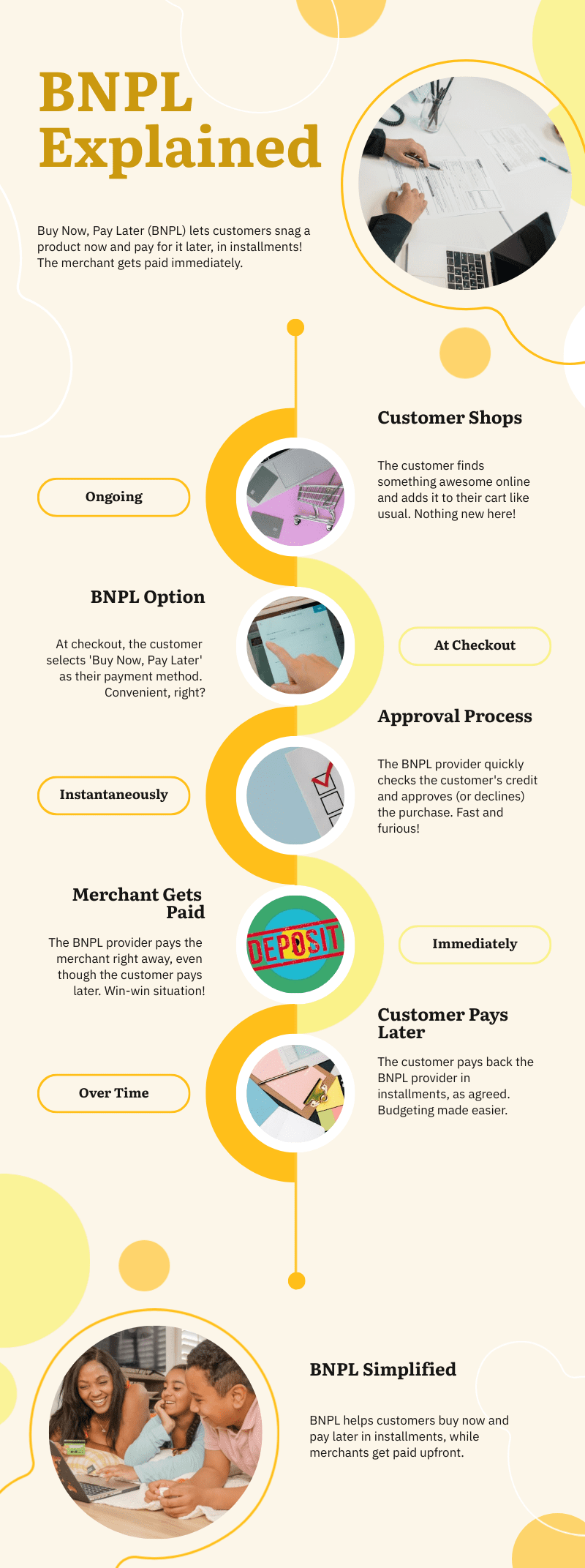

What is Buy Now Pay Later for Digital Products?

BNPL Definition: Buy Now Pay Later for online courses and digital products allows customers to split purchases into 3-4 installments over 6-8 weeks. Popular providers include Klarna, Afterpay, Affirm and Sezzle, which integrate with payment processors like Stripe to offer these options automatically at checkout.

The mechanics are straightforward: The BNPL company pays you upfront (minus their fees), and your customer makes payments to them over time. If you’re using Stripe, whether customers see these options depends on your account configuration, customer location, purchase amount, and the customer’s eligibility with each provider.

Here’s what most people don’t realize: you might not have actively chosen to offer BNPL, but Stripe’s algorithms are making that decision based on various factors. This means BNPL could be appearing at your checkout without you even knowing it.

The Real Story: How BNPL Can Backfire

I had a client ask me about using BNPL for their high ticket program.

Here is what I told her: Picture it! Sicily!

You offer your client BNPL instead of taking on the payment plan yourself. Great! You think! If something happens (nothing is going to happen, right?), then I still get my money and I also get to avoid having to have a tough conversation around money! They will trust that I am doing the best for them, and it will all be well and good and I’ve solved my cashflow issue. Brilliant!

Then, three months in to a 12 month program, your client hits a rough patch. Job loss, family emergency, non-controllable loss of income. Whattya know? Life happened.

Without BNPL, this will be a conversation for you and your client. You would figure out a solution together with your client. Maybe pause payments for a month, extend the program, or work out a modified schedule. Because here’s the thing: when someone is going through transformation, they need support, not stress about missed payments.

But with BNPL? You, the business owner, have zero control. Your client will be hit with late fees, her credit score will take a hit, and she will eventually be banned from the platform and using BNPL in the future in other companies that have nothing to do with the work you were doing together. AGAIN, WITHOUT YOU, THE BUSINESS, BEING ABLE TO HELP.

The client who comes to you for empowerment leaves feeling worse about herself and her finances than when she started. Which is the exact opposite of what your programs are out there to do, and is against your core values. DOH.

Y’all. We need to think about BNPL strategically, not just see it as an automatic conversion booster.

The Hidden Costs of BNPL (That No One Talks About)

The Financial Reality

Those advertised fees of 3-6%? That’s not the whole story. When you factor in your regular payment processing fees, you’re looking at 7-8% total. For a $1,000 course, that’s $70-80 coming out of your pocket before you’ve even delivered value.

But the real costs aren’t financial—they’re relational and ethical.

The Relationship Cost

BNPL removes your ability to be human when your clients face, well, life. You can’t offer grace periods, payment pauses, or work out custom solutions. The rigid collection process can damage the very relationships and people you’re trying to nurture through your teaching, coaching or courses.

The Client Welfare Cost

The thing I get real iffy about: BNPL can push financially vulnerable clients deeper into debt cycles. Late fees, credit score impacts, and platform bans aren’t just inconveniences. They’re life-changing consequences that can make someone’s financial situation significantly worse, for a long time.

The BNPL Ethics Dilemma: Profits vs. People

How BNPL Companies Actually Make Money

Here’s something that makes me uncomfortable about all credit companies. And to be sure, BNPL companies make money the same way: they profit from defaults. Late fees, interest charges, credit impacts—these aren’t unfortunate side effects of their business model. They’re features. They NEED your clients to default in order to keep their doors open.

When customers struggle to make payments, BNPL providers collect additional fees. When they default entirely, it impacts credit scores and can lead to platform bans that affect future purchasing power. The customers most likely to use BNPL—those who can’t afford to pay upfront—are also the most vulnerable to these consequences.

The Coach’s Responsibility

As transformational entrepreneurs, we need to ask ourselves: Are we okay with our payment system potentially profiting from our clients’ financial struggles?

I’m not saying there’s a right or wrong answer. But I am saying we need to ask the question consciously, not just default to whatever increases conversions.

Me, personally? I am fine with using BNPL for something that is a fast recoup – maybe a few hundred dollars – but I can do that in my own business, because I’ve managed the money to do such. Do I add BNPL just so that I can “get my money faster?” For me? Nah, that’s a level of scarcity I am not about to entertain.

For others, perhaps. You have to do what is alignment with your values. Still, I ask you to consider the following red flags.

Red Flags: When BNPL Becomes Predatory

BNPL crosses ethical lines when:

- You’re targeting clients already in financial distress selling something that will bring them out of that financial distress (or if you’re selling a SKILL that you claim will allow them to make more money)

- You’re selling high-ticket transformational promises to populations that you have data around being vulnerable (this doesn’t mean getting in people’s pocketbooks, okay?)

- You’re not offering alternative payment options for those who need them and would be better served by them

- You’re not educating clients about the real risks and consequences of BNPL and exhibiting a “it’s not my responsibility that they didn’t know the risks” attitude

Strategic Decision Framework: When to Use (and Avoid) BNPL

Here’s the framework I use to decide when BNPL makes sense:

The Four-Question Filter

1. Is this a low-touch or high-touch offering? High-touch programs require relationship flexibility that BNPL destroys. High-touch (which, ahem, all 1:1 service, helping, and teaching work is, thankyouverymuch) = avoid BNPL. The relationship cost is too high.

Coaching, masterminds, tuition, and VIP programs need your ability to show compassion when life happens.

2. What’s the price point?

One time cost under $500: BNPL might work for self-guided products Over $500: Proceed with extreme caution, especially for transformation-focused offers

3. How central is this to my core business? Core offerings = avoid BNPL. Core offerings need maximum flexibility and relationship control. Save BNPL for supplementary products and lead magnets.

4. Who is my ideal client for this product? Financially stable = BNPL less risky. Financially vulnerable = avoid BNPL.

If you’re serving financially vulnerable populations, BNPL can push them deeper into cycles of debt and stress.

Where BNPL Actually Works

Perfect candidates:

- Self-guided courses under $500

- Digital downloads and templates

- Entry-level offerings that serve as lead magnets

- Products with minimal ongoing customer interaction

Why it works here: Lower financial stakes, no ongoing relationship requirements, and higher conversion rates can justify the fees.

Where BNPL Becomes Problematic

Avoid BNPL for:

- High-touch teaching, tuition, coaching programs

- Premium masterminds and VIP services

- Any offering where you’re building long-term relationships

- Programs specifically serving financially struggling clients

BNPL Providers: Quick Comparison

| Provider | Typical Fees | Payment Schedule | Credit Check | Best For |

|---|---|---|---|---|

| Klarna | 5.99% + processing | 4 payments, 6 weeks | Soft pull | Products $100-$1000 |

| Afterpay | 6% + processing | 4 payments, 8 weeks | Soft pull | Fashion/lifestyle products |

| Sezzle | 6% + processing | 4 payments, 6 weeks | Soft pull | Younger demographics |

| Affirm | MDR + transaction fee (variable, for merchants) & 0-36% APR (for customers) | Pay in 4: 4 interest-free payments, 6 weeks Monthly: 3-60 months | Soft pull for ‘Pay in 4’; Hard pull for ‘Monthly Payments’ | Higher-ticket items & long-term purchases ($50-$30,000) for a broad demographic |

Note: All providers have additional fees for failed payments and may impact customer credit scores for defaults. The fees above DO NOT include your additional payment processing fees from, say, Stripe or Square.

Ethical Alternatives That Actually Convert

In-House Payment Plans: The Compassionate Choice

Here’s what I dreamed up five years ago and we implement today, cash flow permitting: you can offer payment plans without giving up control or compassion.

Instead of relying on third-party BNPL providers, build your own bank via a strong savings account, and set up your own payment plans through your existing payment processor. With Stripe, for example, you can create subscription-based payment plans that give you complete control over terms, grace periods, and how you handle difficulties.

The benefits of keeping it in-house:

- Pause payments during client hardships

- No credit score impacts for your clients

- No third-party late fees

- Full control over communication and resolution

- Stronger client relationships through difficult times

- You are forced to keep a closer eye on your cash flow, which is good

These practices align with professional coaching standards like those outlined in the ICF Code of Ethics, which emphasizes client welfare and responsible business practices.

Building Payment Plans That Serve

Essential elements:

- Clear payment agreements that protect both parties

- Built-in hardship protocols that maintain dignity – decide ahead of time how you’ll handle it

- Flexible communication strategies for payment issues

- Grace periods that account for life’s unpredictability

- Your own “bank” so you can float your own business if someone does default or needs flexibility

Frequently Asked Questions

Does Stripe automatically show BNPL options?

Stripe’s algorithms determine when BNPL options appear based on your account settings, customer location, purchase amount, and customer eligibility. You can control which providers are enabled in your Stripe dashboard.

Should I offer buy now pay later for my online course?

It depends on your course price, client relationship type, and business values. BNPL works best for self-guided courses under $500 where you’re not building ongoing coaching relationships.

What are the real costs of BNPL for course creators?

Beyond the 6-8% total fees, Buy Now, Pay Later can damage client relationships when payments fail, reduce your flexibility in handling financial hardships, and potentially harm clients’ credit scores and financial wellbeing.

Can I disable BNPL for certain products?

Yes, most payment processors allow you to configure BNPL availability by product, price range, or customer type. Check your Stripe settings for specific options.

What happens if my client defaults on BNPL?

The BNPL provider handles collections, which can include late fees, credit reporting, and platform bans. You typically have no control over this process or ability to intervene on your client’s behalf.

Is BNPL ethical for coaching programs?

BNPL raises ethical concerns for teaching and coaching because it removes your ability to show compassion during client hardships and can push financially vulnerable clients deeper into debt cycles.

What This Could Look Like in Practice

Let me paint you a picture of how this works in a real business:

Sarah’s Music Teaching and Course Empire:

- $100 Digital How-to-Practice Pack Downloadable: BNPL enabled (low-touch, low-risk)

- $500 Self-Guided Course: BNPL enabled (self-directed, reasonable amount)

- $2000 Group Coaching Program: In-house payment plan (high-touch, relationship-critical)

- $5,000 1:1 Program or Tuition: In-house payment plan with application process

Sarah will see her conversion rates stay strong in the lower cost items while dramatically improving client relationships and reducing payment-related stress—for both her and her clients— in the higher cost items.

Making the Strategic Choice

Here’s the bottom line: your payment options are a reflection of your values and your business model. They’re not just operational decisions, they’re strategic ones that impact every relationship you build.

BNPL can be a powerful tool for the right products at the right price points. But for those of us in the transformation business, the most important consideration isn’t conversion rates—it’s whether our payment systems support or undermine the relationships we’re trying to build.

The goal isn’t to make sales easier—it’s to make them sustainable, ethical, and aligned with the transformation you’re here to create.

Before you automatically enable every BNPL option available, ask yourself: Does this serve my clients’ best interests and support the kind of business I want to build?

Your payment strategy should be as intentional as everything else you do in your business. Because at the end of the day, how you handle money is how you handle relationships—and in the transformation business, relationships are everything.

Take a moment to audit your current payment options using the four-question filter. Which of your offerings truly benefit from BNPL, and which ones need the flexibility and compassion that only you can provide?

The choice is yours—make it consciously.

Want more of this? Sign up for the newsletter to get exclusive content worth reading in your inbox

0 Comments